A design flaw in the DEX's price representation logic can render certain trading pairs non-functional. The internal price calculation for pairs where a high-value base asset is quoted in a high-decimal asset (e.g., WBTC/DAI) can exceed the maximum value of the Udec128_24 type used for storage. This causes transactions to fail, effectively creating a denial of service for that market.

Readme:

The DEX contract is intended to work with tokens with >= 0 and <=18 decimal places (ie, issues related to the token having >=0 and <=18 decimals can be considered valid and in scope) and prices as low as 0.00001 USD (an example of this would be the SHIB token).

The internal price is stored as a Price, which is a type alias for Udec128_24. This is a 128-bit unsigned number with 24 fixed decimal places. Its maximum representable value is (2^128 - 1) / 10^24, which is approximately 3.4e14.

The DEX converts human-readable prices into an internal format by scaling them based on the decimal counts of the two tokens involved:

Internal Price = Nominal Price * (Base Unit of Base Token / Base Unit of Quote Token)

The issue is that for certain valid pairs under the README's definition, this scaling formula produces a result that overflows the Udec128_24 limit. A concrete example is the WBTC/DAI pair.

- Pair: WBTC (base) vs. DAI (quote)

- Nominal Price: 1 BTC = $110,000 DAI

- Decimals:

- WBTC (base_decimals): 8

- DAI (quote_decimals): 18

- Internal Price = 110,000 * 1e-8 / 1e-18

- Internal Price = 110,000 * 10^(18 - 8)

- Internal Price = 110,000 * 10^10

- Internal Price = 1.1e15

This calculated Internal Price of 1.1e15 is substantially larger than the maximum representable value of ~3.4e14. The price itself cannot be stored, leading to an arithmetic overflow.

This failure directly contradicts the README's promise to support all tokens with 0 to 18 decimals, as this common and realistic pair is fundamentally incompatible.

Alpha: make sure to check if all the variables and math operations work with all tokens in the readme. Low decimal variables should raise questions.

Conclusion

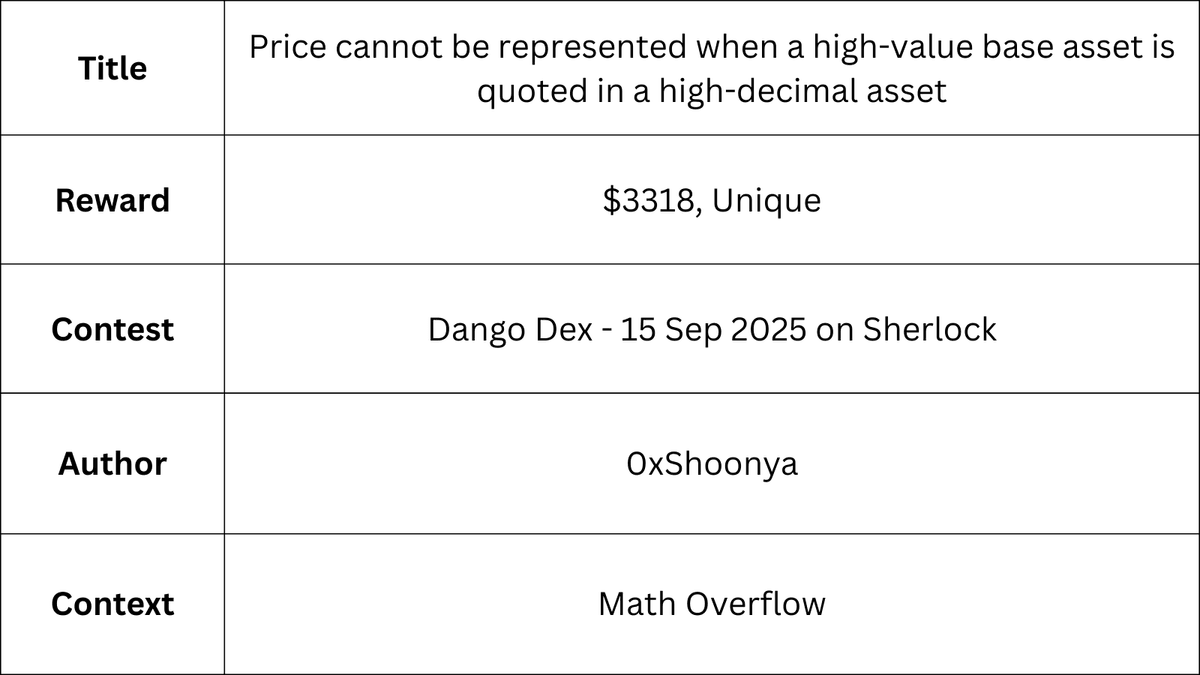

This finding would earn you $3318, and again, can be come up essentially by adding to your check list that all tokens in the readme must correctly work with the codebase.

Full Report

Codebase