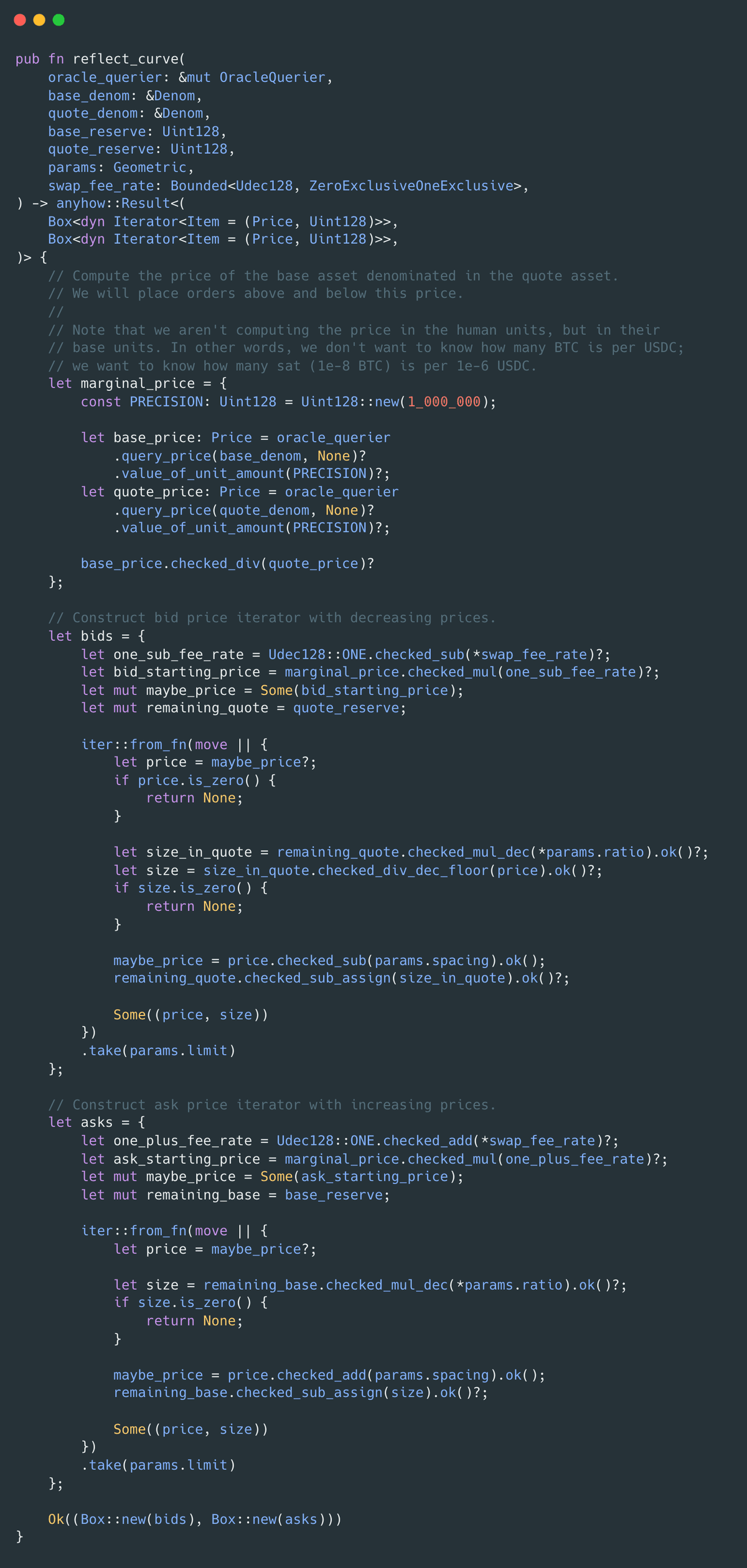

The geometric pool reflects passive orders centered at the oracle price, independent of pool balances.

Prices across levels are spaced by a fixed tick spacing and order sizes follow a geometric ratio of remaining inventory.

The problem here is that asymmetric liquidity provision allows performing a virtual swap, that is effectively at oracle price, that ignores the spacing and geometric ratio parameters, this allows effectively purchasing up to the entire liquidity in the pool, bypassing the price increase applied by the geometric pool for increasing liquidity.

Initial State

Suppose we have a geometric pool consisting of 10 ETH and 20000 USDC. The price is 1 ETH = 2000 USDC and the swap fee is 0.1%.

An attacker wants to swap 1 ETH for USDC in this pool.

Path 1

They can call add_liquidity with 2.222 ETH. They then immediately burn the LP tokens via withdraw_liquidity to withdraw some ETH and USDC, realizing their virtual swap performed during the asymmetric deposit.

USD value of virtual swap: x = 4444 * 20000 / (20000 + 20000 + 4444) = 2000

FeeRate = 2000 * 0.001 / 4444 = 0.00045

ETH = (1 - 0.00045) * (44,444 / 40,000 - 1) * (44,444 / 40,000)⁻¹ * 12.2222 = 1.2215

USDC = (1 - 0.00045) × (44444 / 40000 - 1) * (44,444 / 40,000)⁻¹ * 20000 = 1999

Noticeably, we can always obtain a 1 ETH to 2000 USDC trade from the geometric pool irregardless of the params.spacing and params.ratio.

Path 2

In comparison, suppose our params.ratio is 0.05 and the params.spacing is 100 USD.

We obtain the following relevant price bands:

0.5 ETH @ 1998 USDC

0.475 ETH @ 1898 USDC

0.45125 ETH @ 1798 USDC

To fill our 1 ETH ask, we execute the orders 0.5 ETH @ 1998 USDC, 0.475 ETH @ 1898 USDC and 0.025 ETH @ 1798 USDC, this yields ~1946 USDC. As seen, performing the asymmetric liquidity provision exploit can allow bypassing the price bands of the geometric pool and allow obtaining a better swap for at the flat oracle price.

Conclusion

This finding would earn you $4480, and is another example of thinking critically about how can the outcome be achieved in the system in a cheaper way? In this case, the single sided liquidity provision is abused to then withdraw USDC, simulating a swap with better pricing.