The borrow fee rate returned by the smooth rate curve is an annual percentage yield (APY), but the implementation multiplies it directly by elapsed seconds without annualizing. This treats an annual rate as if it were a per-second rate, inflating fees by roughly 31,536,000x over the intended amount. Borrowers are charged massive, unjustified fees even over short time intervals.

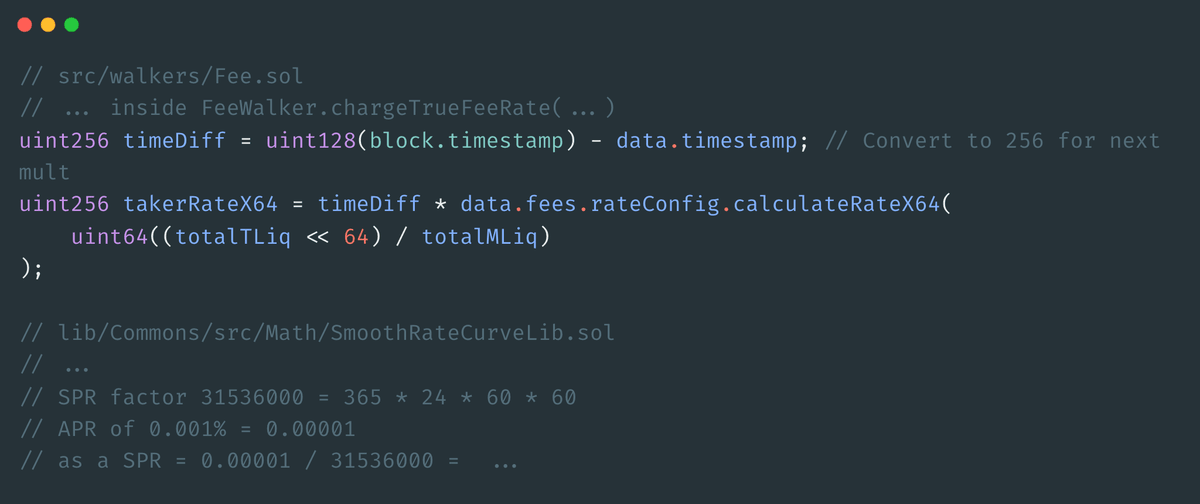

The function chargeTrueFeeRate in src/walkers/Fee.sol treats the APY returned by calculateRateX64 as a per-second rate by multiplying it by the elapsed seconds timeDiff without dividing by the number of seconds in a year. However, the rate returned by the curve is an annualized rate. The library documents that the seconds-per-year (SPR) factor is 31,536,000 and distinguishes APR vs SPR:

Therefore, the correct computation must divide by 365 days to convert the annual rate to a per-second rate before applying timeDiff.

Alpha: the code could have been correct if not for the comment saying what value the variable takes, since it is possible to set the return value to an annualized rate, so make sure to take this in consideration.

Conclusion

This finding would earn you $4432, and is actually quite tricky because you would need to check what value the calculateRateX64 function returns, either per second or total in a year.